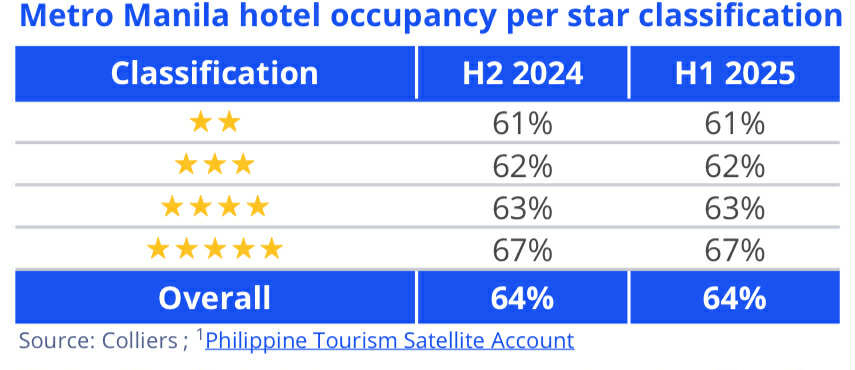

Hotel occupancy in the Metro Manila market remained stable in the first half of the year at 64 percent, supported by demand from domestic tourists and in-person events, according to a diversified professional services and investment management company.

Hotel occupancy in the Metro Manila market remained stable in the first half of the year at 64 percent, supported by demand from domestic tourists and in-person events, according to a diversified professional services and investment management company.

Data from Colliers Philippines showed that hotel occupancy in Metro Manila increased by one percent in the first half of the year compared to the same period last year.

“In our view, hotel demand will continue to be driven by domestic tourists and business travelers. The latter is partly lifted by sustained demand for MICE facilities,” Colliers Philippines said.

It added that for this year, it expects hotel occupancy to hover at 60 percent as international arrivals have yet to return to pre-pandemic levels, while a sizeable number of new hotel rooms are expected to come online in H2 2025, putting downward pressure on occupancy and daily rates of 3-star hotels.

In terms of hotel supply, Colliers recorded the completion of 97 rooms, with the opening of Novel Hotel Manila in Taguig City in the first half of the year.

In terms of hotel supply, Colliers recorded the completion of 97 rooms, with the opening of Novel Hotel Manila in Taguig City in the first half of the year.

The investment services firm said it projects the completion of 1,500 new rooms this year, lower than its previous estimate of 2,700 rooms due to construction delays of hotels located in San Juan, Bay Area and Quezon City.

Among hotels expected to be open in the remainder of the year are Somerset Valero Makati (176 rooms), Alino Hotel New Manila (128 rooms), Seda One Ayala (413 rooms), AC Hotel Ortigas (150 rooms), Vibe Hotel Alabang (144 rooms), Seda Hotel Arca South (265 rooms), and Copeton Baysuites (hotel component) with 140 rooms.

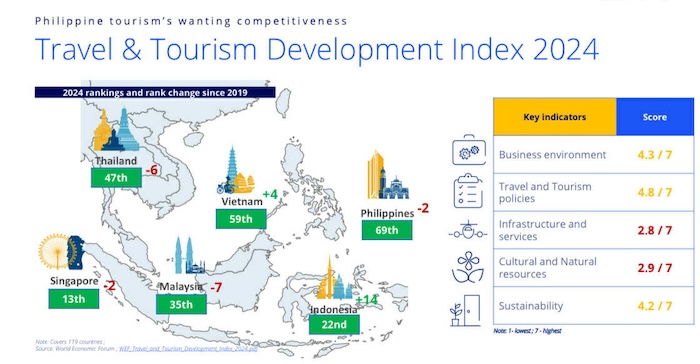

Colliers said an annual completion of around 1,600 new rooms is expected until 2027, with the Bay Area and Quezon City likely to account for more than 50 percent of the new supply during the period. “With the Philippines paling in comparison to its peers in terms of foreign tourists as well as travel and tourism competitiveness, the country has one of the lowest foreign hotel brand penetration in the region,” Colliers said.

“With the Philippines paling in comparison to its peers in terms of foreign tourists as well as travel and tourism competitiveness, the country has one of the lowest foreign hotel brand penetration in the region,” Colliers said.

“International hotel brands continue to look for expansion sites across the Philippines’ more than 7,600 islands but infrastructure connectivity and a solid tourism branding are crucial in enticing billions of foreign investments into the country’s hospitality sector – two areas where the Philippines ranks disappointingly globally,” it added.

Colliers Philippines Director for Research Joey Roi Bondoc emphasized that much needs to be done for the Philippine tourism sector as the country lags in total arrivals compared to its ASEAN peers and our recovery to pre-covid figures remains lackluster.

“We need to ensure that the country’s travel and tourism sector is competitive to attract more foreign investments into the sector and to generate more jobs in the countryside. The Philippines has more than 7,600 islands and in every islet and corner of the archipelago there’s always more to explore,” Bondoc said.

Colliers stressed that there is a strong case for the Philippine leisure sector to diversify its tourism markets and expand MICE facilities, especially now that conferences and business events continue to flourish.

“Colliers believes that the domestic market will likely help fill the void left by plummeting South Korean and Chinese tourists so it’s pivotal for hotel operators and other leisure-related businesses to continue innovating to corner the local market’s expansion. These measures should pave the way for a more vibrant tourism sector moving forward,” the investment management firm said.

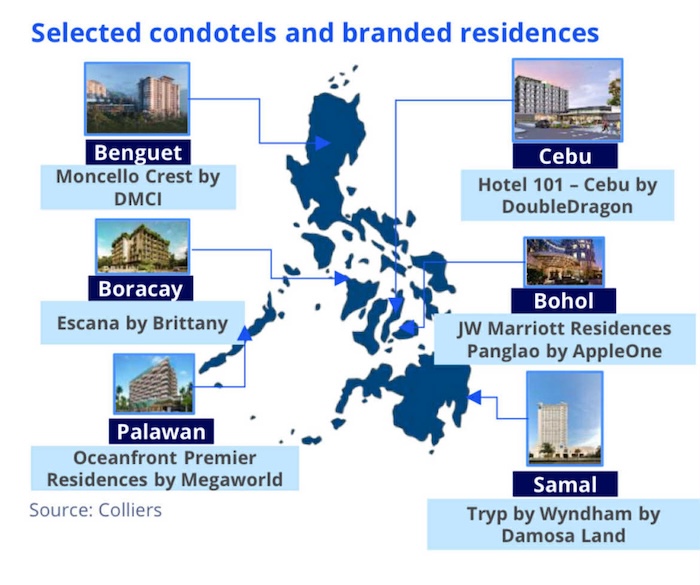

Moreover, Colliers noted that property developers are heavily differentiating given the Philippine leisure sector’s evolution. It added that firms with leisure footprint are building hotels and condotels complemented by golf courses as well as scenic views.

Moreover, Colliers noted that property developers are heavily differentiating given the Philippine leisure sector’s evolution. It added that firms with leisure footprint are building hotels and condotels complemented by golf courses as well as scenic views.

“Hotel operators should prudently assess what the market requires and should add amenities that cater to the needs of business travelers, backpackers, and staycationers,” Colliers said.

It added that more hotel operators are also putting a premium on sustainability, and this is one trend that we see likely to be highlighted by developers in the years to come.

“Whether in the form of business and lifestyle amenities or topnotch concierge services, hotel operators should drum up their key offerings to stand out in the market. This is crucial especially as we attempt to attract more business conventions and international sporting events particularly in thriving MICE hubs outside Metro Manila such as Clark, Cebu, Iloilo, Davao, Cagayan de Oro, and Bulacan,” Colliers said.